From there, I clicked “next” and was taken to a page that flagged all issues that may hinder a successful payroll run. I could click “resolve exceptions” to work out these issues before running https://www.bookstime.com/ payroll. Paychex Flex is made specifically for small businesses that need a quick and simple payroll system. It’s stripped down for businesses that just need easy payroll, with flexibility to add on services as you grow. Paychex Flex earns a 4.2 out of five stars on G2 with 1,485 user reviews and a 4.1 out of five stars on Capterra with 1,547 user reviews. Users say the platform is easy to use both on the employer and employee end.

Other Accounting Software With Payroll for Small Businesses

For example, workers’ compensation is recognized as an expense once the time period that the premium covers has elapsed. At that time, if the payment has not been made, the amount becomes a debt and should be recorded as a liability until it’s paid to the insurance provider. You can record your payroll system’s transactions, income, and expenses using reliable accounting software. And as long as you do everything according to the law and on time, your whole accounting system payroll bookkeeper will thrive in no time.

- There are key differences between bookkeepers and accountants that you want to know before hiring a financial professional.

- This change initiates changes in tax withholdings, tax filings, payroll calculations, healthcare deductions and more, all without the manager having to lift a finger.

- A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses.

- The platform offers a checkbox option to invite the added employee or contractor to fill out the rest of the information themselves.

- Payroll is a liability, as are all expenses related to it like wages payable, salaries payable, or accrued wages payable.

- Even if you’ve paid all taxes due, keep a record of local, state and federal taxes paid.

Journal Entry to Record $10,000 in Payroll Expense

A bookkeeper is responsible for recording and maintaining a company’s daily financial transactions. They also prepare reports for the managers and trial balances to assist the accountants. A bookkeeper may also help you run payroll, collect debts, generate invoices and make payments.

- Then, when your business season kicks back in, simply reactivate your subscription and account.

- You may find that hiring an accountant or bookkeeper to record these transactions can help you spend more time working on your business.

- Second, payroll accounting provides an accurate and objective view of the overall employee cost.

- I tested Gusto’s Simple plan features using the Google Chrome browser on a Windows laptop and the Gusto Wallet app on an Android mobile device.

- Business owners that choose to do manual payroll should ensure that employees accurately document the time they work.

- Use it to facilitate direct deposit as well as to manage payroll checks, taxes and reporting.

Manage and pay your team with confidence

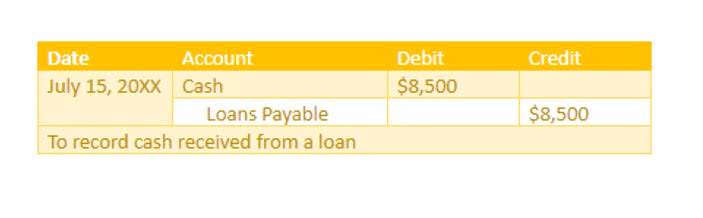

Businesses should stay up to date on their payroll accounting, both for their financial knowledge and to stay compliant with government regulations. If your business is ever audited, you need records of your taxes and employee compensation. One way to record payroll is to use a series of journal entries. Set up an expense account and liability account within your chart of accounts.

Bookkeeping professionals have their own expertise based on the types of businesses and industries they serve. The benefits of payroll software are payroll accuracy, timeliness and compliance. You want to ensure that you have a reliable professional preview your system implementation to ensure that your payroll is set up completely and in a way that positions you to grow effectively. Additionally, make sure you have support with processing the first few payrolls via your new system to identify and fix any errors. Paycor offers plans for businesses of all sizes, but the software is best for medium and large businesses with more complex HR needs than smaller companies. Adding an employee could not have been simpler in my case, though there was more manual data entry than I preferred.

Once payroll was run, the software summarized how much https://www.facebook.com/BooksTimeInc/ was paid out and when. I was also asked if I wanted a reminder of when payroll should be run again. Overall, this process was self-explanatory and required no learning curve. The dashboard felt cluttered when I landed, but it did offer many tools that I needed at my fingertips. By clicking “run payroll” from the dashboard, I completed a payroll run in just a few clicks. In addition, sometimes you have to choose whom to include in the payroll run.