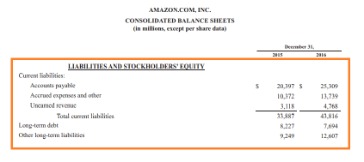

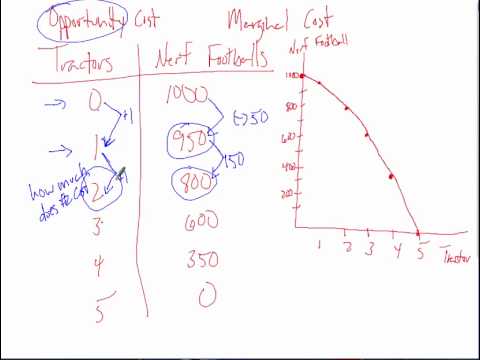

If you’re a business owner or an accountant, you’re likely aware of the crucial role that accurate financial records play in the success of your enterprise. In the realm of financial management, reconciling accounts stands as a fundamental task. It ensures the harmony between your recorded transactions and the reality reflected in your bank statements.

What is Reconciliation in QuickBooks?

Since all of your transaction info comes directly from your bank, reconciling should be a breeze. For other types of accounts, QuickBooks opens the Make Payment window. This lets you write a check or enter a bill to pay to cover the outstanding balance. Here’s how the difference in notes payable vs long you can review all of your cleared transactions. Utilizing the various tools within the reconcile window, such as filters and search functions, further streamlines the process for a comprehensive reconciliation. If you reconciled an account more than once, you likely already reviewed the opening balance.

This not only helps in maintaining accurate financial records but also serves as a crucial reconciliation step to ensure that the company’s books reflect the true financial position. This process is crucial for ensuring that all transactions recorded in the accounting system align with the actual activity in the bank account. By marking transactions as cleared, it helps to confirm that the funds have been successfully transferred and received, providing a clear trail of verified financial activities. This validation step is pivotal in maintaining the integrity and accuracy of financial records, enabling businesses to confidently rely on their financial reports for decision-making and compliance purposes. This process involves comparing the transactions entered into QuickBooks Online with the bank statement to pinpoint any inconsistencies.

This will show you cleared transactions and any changes made after the transaction that may not show in your discrepancies. QuickBooks provides the tools and functionalities to streamline this procedure, allowing for comprehensive adjustments to be made with ease and precision. Maintaining accurate transaction records is vital for financial reporting and decision-making processes within organizations. The beginning balance amount should match what’s on your bank statement for the same start day.

- Reviewing transactions in QuickBooks Online is essential to identify any discrepancies and ensure that the recorded transactions correspond accurately with the bank statement.

- This meticulous approach helps in identifying and rectifying any irregularities, supporting informed decision-making and financial transparency.

- If you’re reconciling an account for the first time, review the opening balance.

- It lets you know if you’re starting with accurate numbers.

We recommend reconciling your checking, savings, and credit card accounts every month. It begins with accessing the reconcile window by navigating to the Banking menu and selecting Reconcile. Then, you’ll need to enter the ending balance from your bank statement and the ending date. Next, review the list of transactions, ensuring that each one matches the transactions on your bank statement.

Bill payments are automatically synced, matched, and categorized in QuickBooks. Having up-to-date and accurate accounts is important for locking cash box any business. You can also make small edits if needed right within this window. For example, if the payee is wrong, you can click on the transaction to expand the view and then select Edit.

Tips for Streamlining the Reconciliation Process

Automated syncing is an excellent addition to QuickBooks and Wise. It will lessen the amount of manual reconciliation and unnecessary cross-checks. You can be more confident that accounts will be up to date and accurate. Once connected, all bills in QuickBooks Online will sync in real-time with Wise.

This process is essential for maintaining accurate financial information and ensuring that the company’s records are in line with its actual financial position. frf for smes frequently asked questions When you reconcile, you compare two related accounts make sure everything is accurate and matches. Just like balancing your checkbook, you need to do this review in QuickBooks.

How to reconcile in QuickBooks: Step-by-step

Once you have your monthly bank statements, you can reconcile your accounts. You’ll compare each transaction in QuickBooks with what’s recorded on your bank statement. At the end, the difference between the account in QuickBooks and your bank statement should be US $ 0.00. No, reconciliation is essential for businesses of all sizes.

How to Reconcile in QuickBooks Online?

By finalizing the reconciliation process, businesses can have confidence in the reliability of their financial records and make informed decisions based on accurate data. This phase is crucial as it ensures accuracy and integrity in financial reporting, aiding in identifying any discrepancies or errors that need to be resolved before finalizing the reconciliation process. Each time you start reconciling an account, you review the beginning balance in QuickBooks. It’s the amount in the account at the beginning of the time period you’re reviewing. It lets you know if you’re starting with accurate numbers.